Explained What Are Commodities? Why do people invest in commodities?

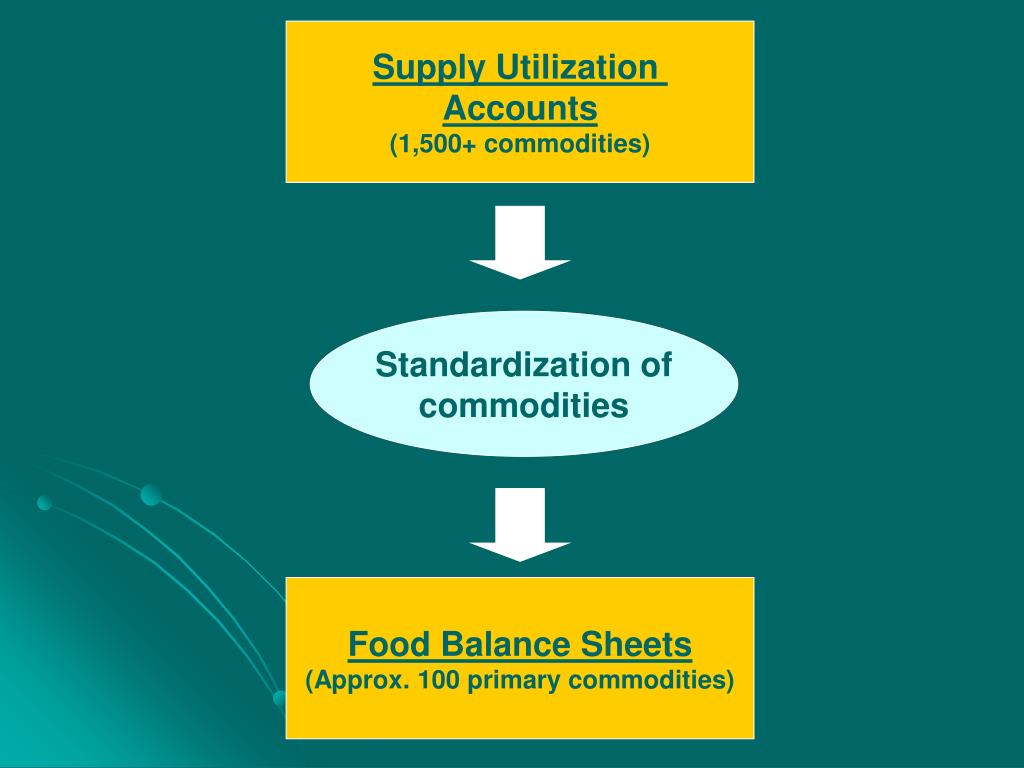

Cover PPT Standardization process of the FBS Examples of various commodities James Geehan (1024x768)

Table of Contents

- What are commodities?

- Why do people invest in commodities?

- Types of commodities

- What is the relationship between commodities and inflation?

- How to invest in commodities

What are commodities?

Commodities are basic goods that are interchangeable with other goods of the same type. They are raw materials or primary agricultural products that can be bought and sold. Commodities are usually produced in large quantities and traded on exchanges. The price of a commodity is determined by supply and demand factors, as well as global economic and political events.

Examples of commodities include crude oil, gold, silver, wheat, corn, coffee, and sugar. These goods are traded on commodity exchanges, such as the Chicago Mercantile Exchange (CME), the New York Mercantile Exchange (NYMEX), and the Intercontinental Exchange (ICE).

Why do people invest in commodities?

People invest in commodities for a variety of reasons. One reason is to diversify their investment portfolio. Commodities are considered to be a separate asset class from stocks and bonds, and can provide diversification benefits. Another reason is to hedge against inflation. Commodities prices tend to rise during times of inflation, which can protect an investor's purchasing power.

Additionally, commodities can provide a good store of value. Unlike paper currencies, which can lose value due to inflation or political instability, commodities have intrinsic value. For example, gold is often seen as a safe-haven asset during times of economic uncertainty, because it is a store of value that is not tied to any particular currency or government.

Types of commodities

There are two main types of commodities: hard commodities and soft commodities. Hard commodities are natural resources that are extracted or mined, such as gold, silver, copper, and oil. Soft commodities are agricultural products that are grown, such as wheat, corn, soybeans, and coffee.

Within each of these categories, there are many different sub-types of commodities. For example, within the hard commodities category, there are precious metals (gold, silver, platinum), base metals (copper, aluminum, nickel), and energy commodities (oil, natural gas). Within the soft commodities category, there are grains (wheat, corn, rice), livestock (cattle, hogs), and softs (coffee, sugar, cotton).

What is the relationship between commodities and inflation?

Commodities and inflation have a complex relationship. On the one hand, commodities prices tend to rise during times of inflation. This is because inflation erodes the purchasing power of paper currencies, and investors tend to seek out commodities as a store of value. Additionally, rising prices can lead to increased demand for commodities, as producers of goods and services look for cheaper alternatives.

On the other hand, rising commodity prices can also lead to inflation. This is because commodities are a key input in many goods and services, and rising input costs can lead to higher prices for consumers. Additionally, rising commodity prices can lead to higher wages for workers in commodity-producing industries, which can lead to higher overall inflation.

- Rachel

- Oliver

- Roger

- Christopher

- Daniel

- Linda

- Ben

- Dr

- Brick

- Margaret

- Old

- Immanuel

- Anthony

- Ric

- Kristen

- Marco

- E

- Matt

- James

- Lolly

- Hans

- Rahul

- Kevin

- Chaim

- Elaine

- Bud

- Bernard

- Deborah

- Gary

- Goldfish

- Cheril

- Jeremy

- Peng

- Frank

- Andy

- Carolyn

- Ruth

- Martin

- RH

- Robert

- Scott

- Armen

- Katrina

- Kimiko

- Bianca

- 20th

- Ahmed

- Nelson

- Cullen

- Kathy

- Steve

- Dot

- Flo

- Chuck

- Britt

- Elizabeth

- Jerissa

- Wolfgang

- W

- Ola

- K

- Eloy

- Example

- Kay

- Andrea

- Craig

- Dawn

- Noah

- Bruce

- James

- Ken

- Frederick

- Ernst

- Fables

- Anthony

- Judith

- K

- Victoria

- Shabnam

- Jasper

- Dr

- ITMB

- Graham

- Living

- Herbert

- Howard

- B

- Laura

- Chris

- Kawaii

- Julia

- Darcy

- Philip

- the

- Robert

- and

- Ferne

- LJ

- John

- S

- Andy

- Lisa

- Joan

- Kamala

- Charles

- Steven

- Richard

- Elsevier

- Dylan

- Spark

- Sanae

- Coloring

- Thomas

- Shirlee

- Richard

- C

- Jordan

- Roger

- Edward

- Thomasina

- Building

- Christian

- Students

- Dennis

- H

- Stephen

- DigiDiscover

- Thomas

- Tara

- Greg

- Halimah

- J

- Creekside

- Kal

- Charlotte

- Andreas

- Bruce

- Thomas

- Julian

- Mary

- Nicole

- Nathan

- Jacqui

- Nick

- Richard

- Daddy

- Steve

- Amira

- ArtZen

- Maria

- Erma

- Kuri

- E

- Deanna

- Mary

- Kenneth

- Aseem

- John

- Helen

- Spencer

- Gerald

- Andrew

- Guillem

- Ra

- Mike

- Clover

- Rosa

- Carrie

- Terry

- Neville

- David

- Charles

- Eve

- Eric

- Lee

- Shelly

- Frank

- Genevie

- Thomas

- exploring

- Williams

- Robert

- Deborah

- Christine

- Bergerac

- Cool

- Audrey

- Rico

- Emily

- The

- John

- Jon

- Linda

- Baby

- Mr

- Lonely

- Laurita

- Ellen

- Sandra

- Isa

- Cheri

- Robert

- Anthony

- DK

- Natasha

- Mark

- Benjamin

- R

- Richard

- Caleb

- Anne

- Cameron

- Malcolm

- Van

- Bill

- Tami

- Graham

- Ivey

- Erik

- Erik

- Speak

- Shel

- Susan

- Alfredo

- James

- Kimberly

- Hank

- Kyle

- Anne

- Yuji

- Plato

- Franko

- Alana

- SS

- Jeff

- Harry

- Rebecca

- Janes

- Jan

- Ferdinand

- Catherine

- Jane

- Liedia

- Mike

- Steve

- Hanneke

- Adam

- Frederick

- Jasjeet

- Azra

- Katherine

- Ian

- Roland

- III

- Christopher

- Dan

- Michelin

- Ben

- Captivating

- Wandering

- International

- Steven

- Nana

- James

- Pam

- Stephen

- George

- Nicole

- John

- Elliott

- Clio

- Miss

- Sol

- The

- Ascent

- Roger

- Klaus

- Dot

- Brandon

- Henry

- Shira

- Ovidiu

- Brent

- Richard

- Daniel

- Sadeqa

- Llaila

- Pamela

- Douglas

- E

- Adalbert

- Janet

- Mike

- Mary

- Amy

- T

- Joseph

- Anna

- Choly

- Smart

- Bauman

- Thich

- Tanya

- Edition

- Jacqueline

- David

- Jory

- the

- Marilyn

- Shah

- Jack

- J

- Sid

- Joanna

- George

- John

- Neal

- Nestor

- Freya

- Tim

- Donald

- Jess

- Ryouta

- Dr

- Brad

- Soonhwa

- DK

- Donald

- David

- Ludwig

- FanPro

- Primavera

- Bruce

- Janice

- Ross

- Howard

- Gary

- Joachim

- Dr

- Brian

- Lissette

- Jack

- Jeremey

- John

- Chris

- Dr

- Jendayi

- Lois

- Inc

- James

- James

- Heather

- Jenny

- Candace

- Nina

- Winelle

- Amanda

- Bruce

- Harry

- Dr

- Kevin

- H

- James

- Eric

- Nico

- Restoring

- Karen

- Ann

- Example

- USketch

- Anne

- Dugald

- Domenico

- Julia

- kayunga

- Lisa

- Cyan

- David

- Pam

- David

- Modern

- Makayla

- Jennifer

- Moss

- Justin

- the

- Jimmy

- 3dtotal

- Arthur

- Limitless

- Paul

- Kristie

- Al

- Bradley

- Arnold

- William

- Gale

- C

- Matt

- Cokie

- Harriet

- E

- Jason

- Kashmir

- Rory

- Mihalis

- J

- Rick

- Eric

- Louis

- Margaret

- Barbara

- Richard

- United

- Scarpino

- Rose

- Alfred

- W

- Wolf

- Anne

- Melanie

- Fran

- Ernest

- Steve

- Auntie

- Lisa

- Kate

- Saki

- Tony

- Malcolm

- Merriam

- The

- Kevin

- Matthew

- Dietrich

- Jada

- St

- Nursing

- Robert

- Brana

- Sam

- Terry

- Carl

- Jordan

- Howard

- Willy

- 30

- Artists

- Springer

- John

- Claude

- Inc

- Mark

- Temple

- Daniel

- Donald

- Professor

- Jim

- Brandon

- Andrea

- Garry

- Dan

- TriviaHead

- William

- Nancy

- Ian

- J

- Carlos

- Brenda

- Serhii

- Patti

- David

- Ken

- Frances

- Cait

- Jason

- Itzik

- Sariah

- Ashish

- Rahul

- AA

- Tony

- and

- Scott

- Jim

- Robert

- Andrea

- Edmund

- Julian

- Gabriela

- Lyudmil

- Sajni

- Phillip

- Ian

- Richard

- Richard

- Thomas

- Joan

- Sun

- Matt

- Michael

- Zondervan

- Lynne

- Steven

- Gunther

- Laurent

How to invest in commodities

There are several ways to invest in commodities. One way is to buy physical commodities, such as gold coins or silver bars. This can be done through a dealer or broker, but investors should be aware of storage and insurance costs.

Another way to invest in commodities is through futures contracts. Futures contracts allow investors to buy or sell a specified amount of a commodity at a predetermined price and date. Futures contracts are traded on commodity exchanges and are highly leveraged, which means that small price movements can have a big impact on profits and losses.

Exchange-traded funds (ETFs) and mutual funds are another way to invest in commodities. These funds invest in a variety of commodities, and provide easy diversification for investors. However, investors should be aware of the fees associated with these funds, as well as their investment objectives and strategies.

Conclusion

Commodities are an important asset class for investors, providing diversification benefits, protection against inflation, and a store of value. There are many different types of commodities, each with their own unique supply and demand factors. Investors can choose from a variety of investment vehicles, such as physical commodities, futures contracts, and ETFs. However, investors should be aware of the risks associated with investing in commodities, including price volatility and geopolitical risks.

Post a Comment for "Explained What Are Commodities? Why do people invest in commodities?"